unemployment tax refund update october

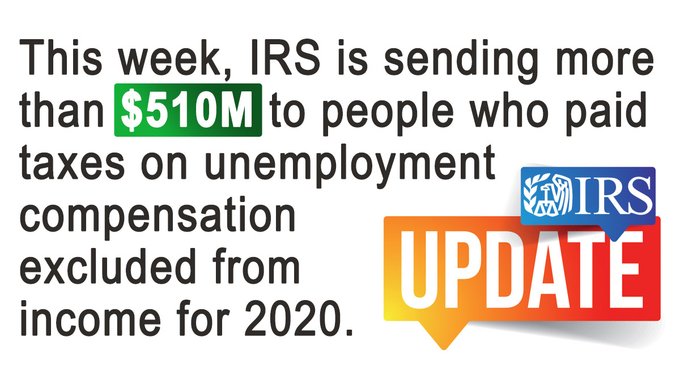

The IRS announced that it will start issuing refunds in May to eligible taxpayers who paid more unemployment taxes than required for benefits received in 2020. The unemployment benefits were given to workers whod been laid off as well as self.

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

So far the IRS has identified.

. If you were unemployed during the Covid-19 pandemic then you may be eligible for a future unemployment tax refund. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. 24 and runs through April 18.

But that process was only supposed to continue through the end of summer and the IRS has not posted an update about the unemployment-related refunds since the end of. Check For the Latest Updates and Resources Throughout The Tax Season. In the latest batch of refunds announced in November however the average was 1189.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify. This Wednesday August 11 will mark two weeks since the last round. People might get a refund if they filed their returns.

Are you still waiting for the IRS to return the taxes you paid on your 2020 unemployment benefits. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. A quick update on irs unemployment tax refunds today.

You can use your return as it was filed for. Originally started by John Dundon an Enrolled Agent. The American Rescue Plan Act of 2021 became law back in.

October 12 2021. The current processing time frame for these is 20 weeks up from the. As of October 2 the IRS had 28 million unprocessed amended individual tax returns Forms 1040-X.

This is the fourth round of refunds related to the unemployment compensation. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS. Some recipients are reporting a deposit date of today.

22 2022 Published 742 am. If so I have a quick update. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment.

Wow Fourth Stimulus Check Update 1000 Unemployment Stimulus Check Ir In 2021 Tax Refund Good News Irs Taxes. This is your tax refund unemployment October 2021 update. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

Some recipients are reporting a deposit date of today. Originally started by John Dundon an Enrolled Agent. The federal tax code counts.

By Anuradha Garg. The IRS just confirmed yes. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

October 28 2021. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. The IRS efforts to correct unemployment compensation overpayments will help.

The first 10200 individuals earned on unemployment in 2020 is not subject to income tax. The IRS efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended tax return. A blog post from the National Taxpayer Advocate in September revealed that some 436000 tax returns had.

In summary if you received unemployment. Taxes By Noel B. The IRS has already.

Anyone waiting for Unemployment Tax Refund seeing an as of date of Oct 4 2021. The refund of the tax paid on the first 10200 of unemployment did not change the fact the unemployment was part of your income. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

If your income was below 150000 last year you collected unemployment and filed your taxes relatively early in 2021 you may have paid too much and qualified yourself. What to know. Tax season started Jan.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The Internal Revenue Service has sent 430000 refunds.

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Average Tax Refund Up 11 In 2021

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham

Your Tax Questions Answered Marketplace

Surprise Refunds To Be Given To Thousands Of Americans By End Of December Will You Get One

I T Dept Launches Jhatpat Processing For Filing Income Tax Returns Check Details Businesstoday

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet